Featured Post

Does Charles Schwab Charge Fees For Trades

- Get link

- X

- Other Apps

Although Schwab doesnt charge anything for a mutual fund phone trade a broker-assisted trade costs the standard 25 extra. Charles Schwab as well as completely 0-commission Firstrade do not have fees and surcharges on Pink SheetsOTCBBstocks priced under 1.

Charles Schwab Penny Stocks Otc Pink Sheets Fees 2021

See the Charles Schwab Pricing Guide for Individual Investors for full fee and commission schedules.

Does charles schwab charge fees for trades. Fortunately there is no charge to sell a transaction-fee fund. Schwabs lineup of mutual and exchange-traded funds carry expense ratios which are probably a very large source of income even though the expense ratios are low. In total there are over 5000 mutual funds available at Schwab.

On October 2 2019 Charles Schwab announced that it would no longer charge any trading fees. The firm has over 3500 OneSource funds which carry no load and no transaction fee. Service charges apply for trades placed through a broker 25 or by automated phone 5.

11 rows Online stock and ETF trades at Schwab are commission-free. Options trading has a standard 065 fee per contract. Your approach to investing in OTCs depends on what type of investor you are.

OneSource funds must be held at least 3 months or the broker will charge a 4995 fee. Schwab does charge a 50 fee to close an account but since there are no low balance nor inactivity fees leaving an empty account open is a viable option. View important information about mutual funds.

Options trades will be subject to the standard 065 per-contract fee. Nevertheless there are a few weaknesses that traders should be aware of. Exchange process ADR foreign transaction fees for trades placed on the US OTC market and Stock Borrow fees still apply.

Trades below 100 in principal are exempt from the transaction fee. There is a trade bar that sits at the bottom of the screen. Service charges apply for trades placed through a broker 25 or by automated phone 5.

Clients must pay a rather uncomfortable 4995 to buy mutual funds that carry a transaction fee. Schwab lowered its commission for stock and ETF trades from 895 to 0 in response to pressure from competitors. Multiple leg options strategies will involve multiple per-contract fees.

Exchange process ADR foreign transaction fees for trades placed on the US OTC market and Stock Borrow fees still apply. Other accounts fees optional data fees fund expenses and transaction charges may apply. Some funds not on the OneSource list also carry the short-term-trade fee.

Most brokers like TD Ameritrade Schwab Fidelity and Etrade will charge you an extra commission for partial executions under certain circumstances whereas others like Firstrade dont charge any commissions at all. Schwab Funds are managed by Charles Schwab Investment Management and are included in the Schwab Mutual Fund OneSource service which offers thousands of no-load no-transaction-fee mutual funds. Schwab may provide certain advisors at no fee or at a discounted fee with research software technology information and consulting services and other products and services that benefit the advisor but that may not necessarily benefit client Account s.

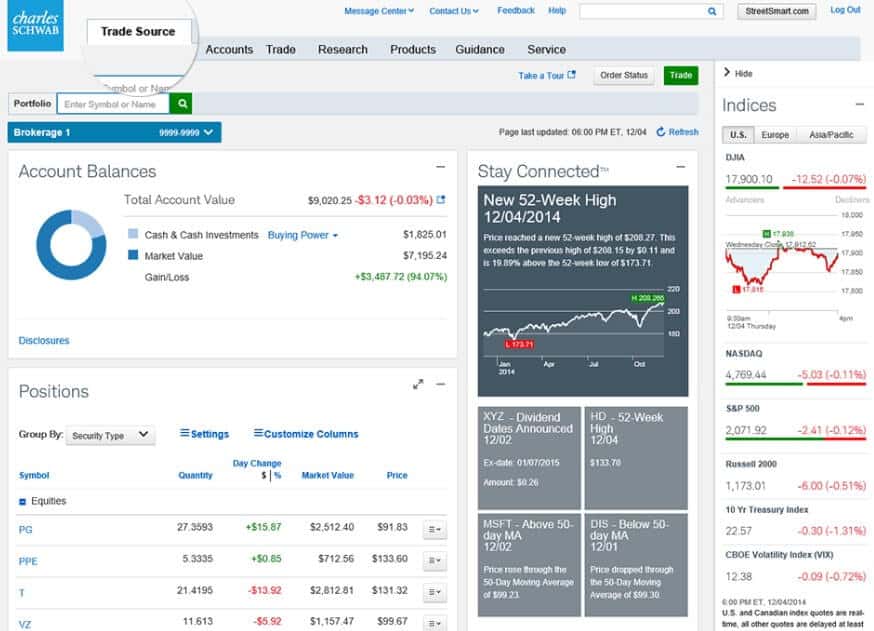

Immediately after the announcement Charles Schwab stock dropped about 9 while firms like TD Ameritrade and E-Trade dropped by even. Schwab Trading Services includes access to StreetSmart trading platforms and Schwab trading specialists a Schwab brokerage account is required. This article will discuss how online brokerages make money charging zero trading fees.

The countrys first real discount brokerage firm Schwab is consistently rated as one of the cheapest brokerage firms in the United States. Charles Schwab does not charge monthly fees on all of its brokerage accounts. Beginning in October 2019 Schwab has reduced fees for all US and Canadian stocks ETFs online options and mobile transactions from 495 to 000.

At Charles Schwab to penny stock trades applies the regular commission rate of 0 per trade. There are no fees to use Schwab Trading Services. Schwab has a lot of useful trading tools and all of them are free of charge.

First on the list is the brokers website which itself is capable of placing trades for many security types including stocks options ETFs and fixed-income products. Mutual funds at Schwab that do have a transaction fee are a somewhat uncomfortable 4995 on the buy side although they are free to sell. Service charges apply for trades placed through a broker 25 or by automated phone 5.

I remember my father using Charles Schwab in the 1990s and being charged 50 a trade. Charles Schwab is a broker with a lot of strengths which is probably why it literally has trillions of dollars in client assets. At Schwab we provide the help you need to build a strong portfolio whichever way you prefer to invest.

See the Charles Schwab Pricing Guide for Individual Investors for full fee and commission schedules. The broker maintains the OneSource Select List. Exchange process ADR and Stock Borrow fees still apply.

You can buy and sell OTCs on your own with a Schwab One brokerage account or call 877-566-0054 to talk to an experienced specialist about whether OTCs are right. 1 Online options trades are 065. See the Charles Schwab Pricing Guide for Individual Investors for full fee.

Charles Schwab 2021 Fees Pros And Cons And Features

Charles Schwab Review 2021 Pros And Cons Uncovered

Charles Schwab Review 2021 5 Things To Keep In Mind

Charles Schwab Pattern Day Trading Rules Pdt In 2021

Schwab Advisor Streetsmart Edge Offers Advanced Quotes Trading And Market Data T3 Technology Hub

Charles Schwab Review See How This Broker Ranked

Charles Schwab Review 2021 Pros And Cons Uncovered

Lookout Robinhood E Trade Schwab Ameritrade Go Zero Fee Techcrunch

Charles Schwab Review 3 Key Findings For 2021 Stockbrokers Com

Vanguard Vs Charles Schwab Cheapest Broker Revealed

Charles Schwab Review 2021 Pros And Cons Uncovered

2021 Charles Schwab Review Platform Pros Cons Benzinga

Charles Schwab Brokerage Account Review Low Cost Index Funds Etfs

Charles Schwab Extended Hours Trading Pre Market After Hours

Charles Schwab Shorting Stocks How To Short Sell In 2021

Charles Schwab Extended Hours Trading Pre Market After Hours

How Could I Luanch The Charles Schwab Trading Tool How To Make Investment In Stock Market Carlos Coelho E Associados

/ScreenShot2020-03-25at4.04.20PM-10218ff3c7314aafac9a19264e9b01c7.png)

/CharlesSchwabvs.ETRADE-5c61bbd646e0fb0001587a71.png)

Comments

Post a Comment